Jordan’s Strategic Energy Landscape

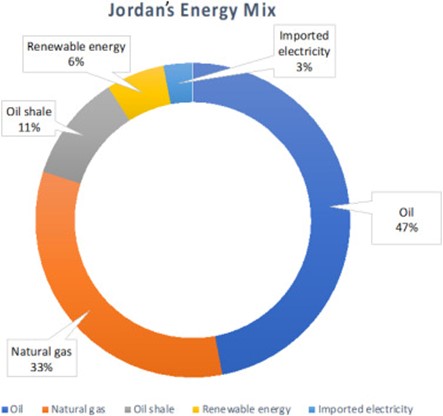

Jordan’s energy strategy showcases a profound commitment to diversifying its energy sources, focusing on reducing its heavy reliance on imported fossil fuels by bolstering its renewable energy sector.

Evolving Energy Profile

- In 2021, the country’s total generation stood at 21.4 TWh.

- Natural gas remains dominant at 72% of the energy mix, while renewable sources like solar (15%) and wind (7%) are rising. Generation mix: natural gas 15.5 TWh (72%); solar 3.3 TWh (15%); wind 1.6 TWh (7%); oil 0.9 TWh (4%).

- Jordan has seen a net export balance in its energy trade, hinting at an increasingly resilient energy economy.

- With a commitment to green energy, approximately 20% of Jordanian homes now harness the sun with rooftop solar water heating systems, a figure anticipated to rise to 30% by 2030.

The Energy Mix in Transition

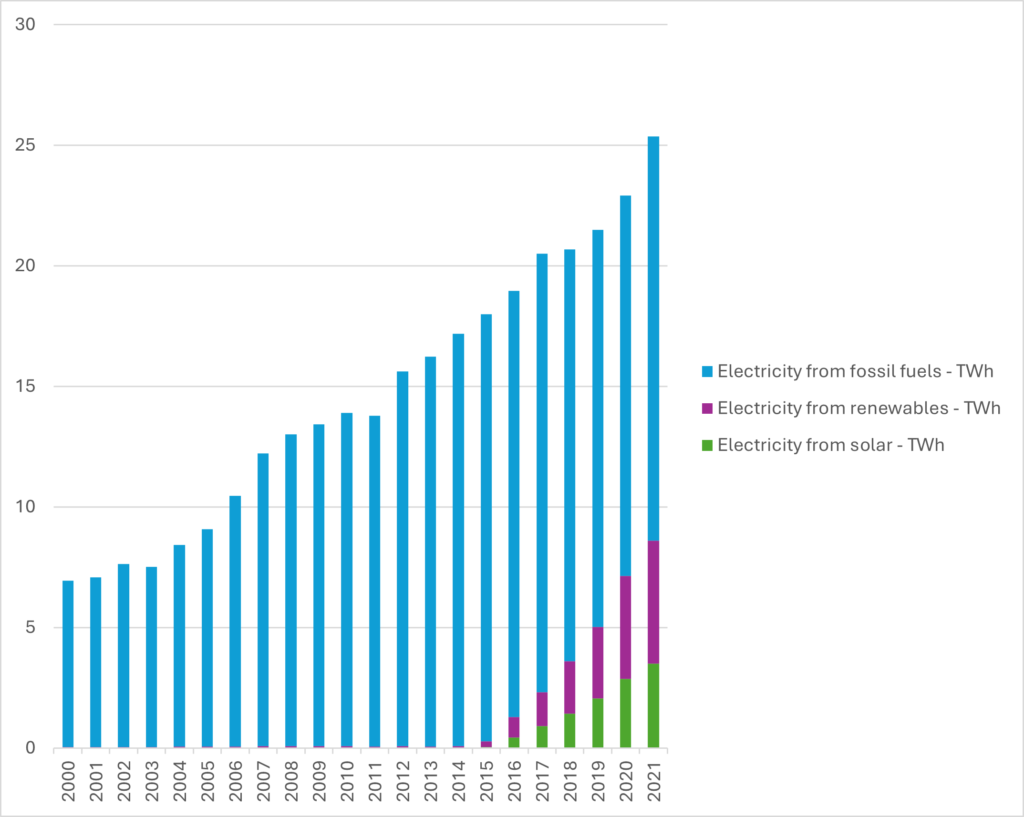

Over the past two decades, Jordan’s journey towards renewable energy has seen remarkable growth. From negligible beginnings in solar power at the turn of the millennium, the nation’s solar energy production soared to 3.5 TWh by 2021. Renewable energy as a whole expanded significantly during this period, with 5.09 TWh produced in 2021, showcasing a progressive shift from Jordan’s traditional reliance on fossil fuels, which was at 16.77 TWh in 2021. This trend reflects Jordan’s committed efforts to diversify energy sources and reduce its carbon footprint, even as total energy generation from fossil fuels has fluctuated, seeing a decrease in the late 2010s before a slight increase in 2021.

| Year | Electricity from solar – TWh | Electricity from renewables – TWh | Electricity from fossil fuels – TWh |

| 2000 | 0 | 0.04 | 6.89 |

| 2001 | 0 | 0.04 | 7.04 |

| 2002 | 0 | 0.05 | 7.59 |

| 2003 | 0 | 0.05 | 7.47 |

| 2004 | 0 | 0.06 | 8.37 |

| 2005 | 0 | 0.06 | 9.01 |

| 2006 | 0 | 0.06 | 10.4 |

| 2007 | 0 | 0.07 | 12.15 |

| 2008 | 0 | 0.07 | 12.94 |

| 2009 | 0 | 0.07 | 13.35 |

| 2010 | 0 | 0.07 | 13.83 |

| 2011 | 0 | 0.06 | 13.71 |

| 2012 | 0 | 0.07 | 15.54 |

| 2013 | 0 | 0.06 | 16.17 |

| 2014 | 0 | 0.07 | 17.11 |

| 2015 | 0.05 | 0.23 | 17.7 |

| 2016 | 0.43 | 0.86 | 17.67 |

| 2017 | 0.91 | 1.4 | 18.18 |

| 2018 | 1.43 | 2.16 | 17.09 |

| 2019 | 2.06 | 2.96 | 16.46 |

| 2020 | 2.87 | 4.27 | 15.77 |

| 2021 | 3.5 | 5.09 | 16.77 |

Harnessing the Sun: Jordan’s Path to Solar Energy Dominance

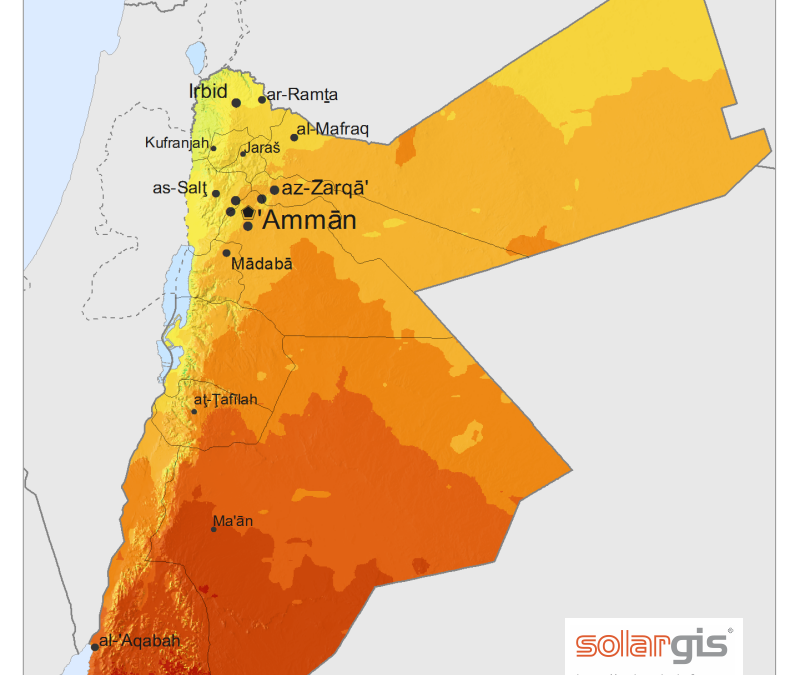

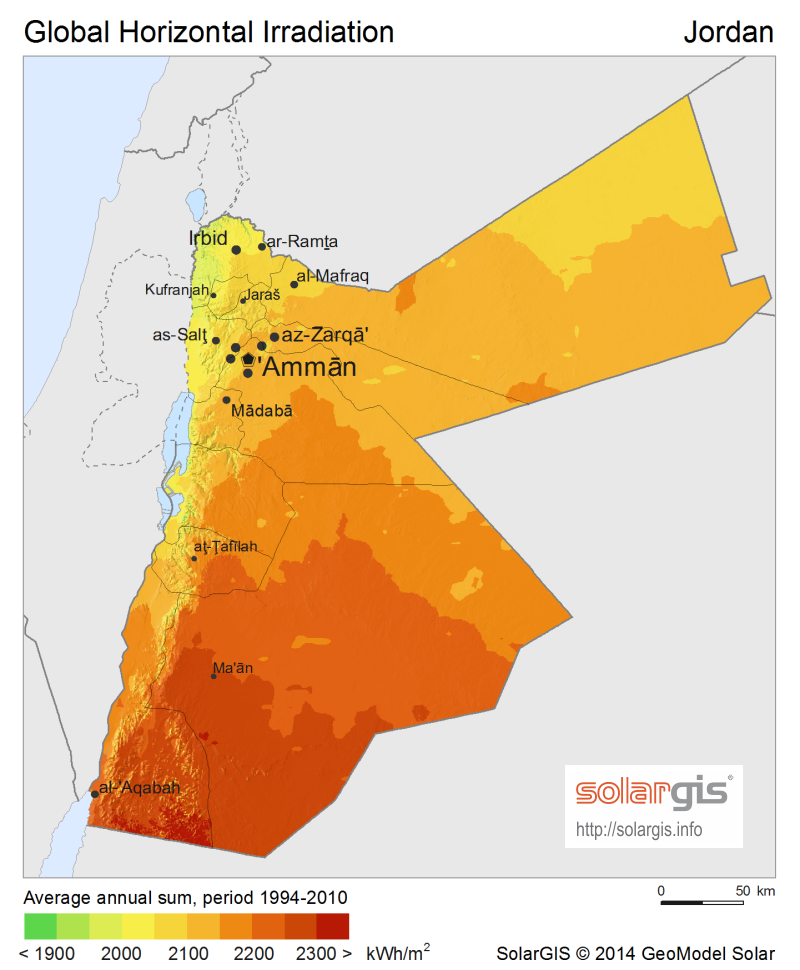

Jordan’s solar energy potential is substantial due to its favorable geographic location, which allows for high solar radiation intensity ranging from 5 to 7 kWh/m^2. The country enjoys an average of 310 sunny days per year, aligning solar electricity generation with peak load demands. With over 500 registered solar installation companies, investment in solar energy is robust in Jordan.

Key Points:

- Southern regions like M’aan and Aqaba receive the most intense solar irradiation, with average daily global irradiance values of 6-7 kWh/m^2.

- The yearly total solar energy map for Jordan (Figure 4 from the document) highlights the extensive solar radiation received across the country.

- Solar PV power is increasingly popular in the domestic sector globally, and in Jordan, it’s used in remote and rural areas for a variety of applications, including water pumping and home lighting.

- About 20% of residences in Jordan have solar water heating systems installed, with an expectation of reaching 30% by 2030.

- On-grid system energy purchases for wind and solar have notably contributed to the national grid, with solar energy units providing 2162.6 GWh in 2021.

Initiatives and Support:

- The Jordan Renewable Energy & Energy Efficiency Fund (JREEEF) supports various sectors, including farming and industry, to enhance renewable energy usage.

- The National Energy Efficiency Action Plan aims to encourage the adoption of renewable power further.

The movement towards renewable energy in Jordan is strong, with various initiatives geared towards enhancing the use of solar energy in domestic buildings. This momentum is set to continue, with plans to optimize policies for residential solar energy systems, improving public engagement and affordability.

Shifting Scales: Jordan’s Nuclear Ambition from Large Reactors to SMRs

Nuclear Power Plans: Large Reactors in Jordan

Strategic Goals:

- The program initiated in 2007 targets nuclear power to supply 30% of Jordan’s electricity by 2030 and aims for the country to export energy.

- The Jordan Atomic Energy Commission (JAEC) and Jordan Nuclear Regulatory Commission (JNRC) were established to oversee nuclear energy, emphasizing safety and environmental stewardship.

Development Efforts:

- Collaborations with international nuclear firms, including Atomic Energy of Canada Limited (AECL) and Korea Electric Power Corp (KEPCO), were made for feasibility studies and site selections.

- Proposals for large reactors were considered, with discussions involving vendors for reactors like the Enhanced Candu-6 and Atmea unit.

Challenges and Adjustments:

- Parliamentary concerns led to a suspension vote on the nuclear program, pushing JAEC to pivot towards more financially viable options.

- Negotiations took place for funding and strategic partnerships, particularly with Rusatom Overseas and China National Nuclear Corporation (CNNC), focusing on cost-sharing and operations.

Project Revisions:

- The initial plan for two AES-92 nuclear units faced cancellation due to high costs and financing issues, leading to a shift in strategy.

- JAEC explored small modular reactors (SMRs) better to fit Jordan’s electricity grid and supply needs.

Regulatory and International Support:

- A series of international agreements and reviews, including those by the International Atomic Energy Agency (IAEA), were conducted to ensure the program’s viability and adherence to safety and regulatory standards.

Nuclear Power Plans: Small Reactors (SMRs) in Jordan

Initial Plans:

- SMRs were considered as a follow-up to large reactors, with a specific interest in several small reactors with a capacity of around 180 MWe.

Collaborations and Feasibility Studies:

- Agreements for feasibility studies were signed with entities like Saudi Arabia’s KA-CARE and Rolls-Royce.

- Discussions and MOUs included a variety of SMR technologies, such as the HTR-PM high-temperature gas-cooled reactor and X-energy’s Xe-100 reactor.

Progress and Partnerships:

- Advanced negotiations with CNNC for a 220 MWe reactor and strengthened cooperation with Rosatom following the cancellation of previous large reactor plans.

- By late 2023, multiple agreements were in place with international partners to develop SMRs.

International Endorsement:

- An IAEA expert mission in 2023 positively assessed Jordan’s feasibility studies for SMR usage, lending credibility to the nuclear program’s direction.

The summary outlines the key points of Jordan’s nuclear power strategy, highlighting the evolution from initial plans for large reactors to a focus on SMRs. It also considers international collaboration, feasibility studies, and regulatory support.